Is it possible to make 17.5% annual return on your real estate purchase?

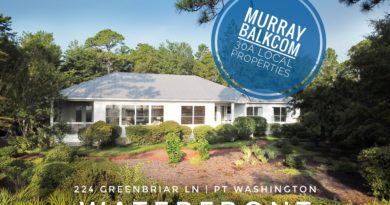

It all depends on how you look at the numbers. There are some great buys here and there in South Walton right now. For example, there is a cute 3-bedroom, 2-bath Florida cottage in Point Washington which is now on the market at $136,900. Rent for similar houses in this neighborhood of Point Washington is around $1,150/mo.

Let’s look at the numbers for purchasing this house:

purchase price: $136,900

20% down ($27,380)

principle of loan $109,520

fixed rate 30 year loan

4.5% interest

approximate monthly interest and principle: $555

approx annual cost of insurance: $1200 ($100/mo)

approx property taxes based on current rates: $1200 ($100/mo)

Total estimated monthly expense of principle, interest, insurance and taxes: $755/month

Using these estimates of income and expense, and considering full-time occupancy, with no rental management company, and with you doing your own maintenance and repairs, this house should produce a positive cash flow of about $400 per month, or $4,800 per year. With your initial down payment of $27,380, that is a return on the cash invested of about 17.5% per year if my math is correct, all while someone else is paying off the note on your house.

I know that people will argue that the debt taken on is part of the investment. It isn’t part of the cash out of pocket, but it is true that it is part of the actual investment. So, using their math of return on investment, $4,800/year is a return of about 3.5% on the total home price, which is still better than the current rate of CDs. Use whichever numbers you want, but at the current price and current rental rates, with a little work being a landlord, this property can still produce a positive cash flow, which is something we haven’t seen in a long time.

To learn more about cash flowing properties like this one, please contact Murray Balkcom, Realtor with The Premier Property Group.